South African Parliament Passes Carbon Tax Bill

In addition to taxing carbon, South Africa has also set ambitious goals for emission reduction. (University of Wisconsin)

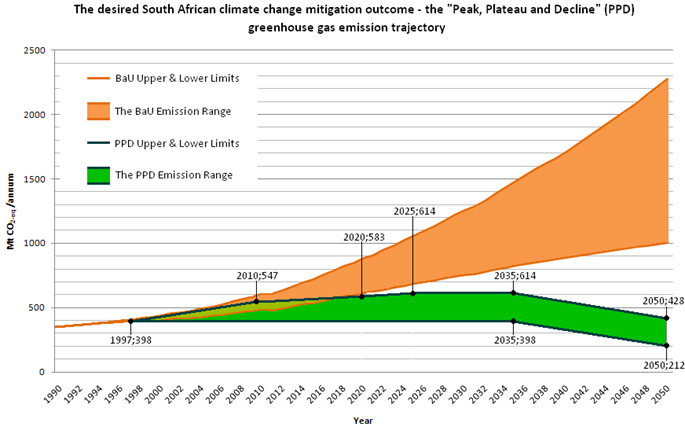

South Africa’s parliament passed a bill on February 19 implementing a national carbon tax in an effort to reduce the country’s greenhouse gas emissions in accordance with their commitments under the Paris Climate Agreement. South Africa currently relies on coal, a very carbon-intensive energy source, for 90 percent of its electricity. Under the Paris agreement, which South Africa ratified in 2016, the government has committed to reduce South Africa’s overall greenhouse gas emissions by 34 percent by 2020 and 42 percent by 2025 as its contribution to the global effort to mitigate the effects of climate change.

In a statement concluding parliamentary debate on the bill, Deputy Finance Minister Mondli Gungubele said, “Climate change poses the greatest threat to humankind and South Africa intends to play its role as part of the global effort to reduce greenhouse gas emissions and to meet its commitments under the Paris agreement.”

The carbon tax penalizes private sector emitters based on the polluter pays principle, intended less as a mechanism to raise government revenue and more as an incentive to shift to greener, low-carbon technology. The tax has been established at 120 South African rand (about eight US dollars) per ton of emissions and will be implemented starting June 2019. Despite the name carbon tax, the tax applies to several greenhouse gasses identified to contribute to global climate change such as methane, nitrous oxide, and perfluorocarbons. The carbon tax will also be implemented in two phases to give businesses time to transition away from existing emissions-intensive technology with the first phase designed to run until December 2022.

The concept of a carbon tax was first brought up in South Africa in 2010 but faced heavy criticism from domestic industry which delayed its passage until this year. Energy intensive industries like Sibanye-Stillwater, South Africa’s largest gold producer, and ArcelorMittal, a steel producer, have expressed the most vocal opposition. Industry pushback resulted in a smaller carbon tax than was originally proposed: the tax rate is designed to increase only two percent above inflation every year as opposed to the originally proposed 10 percent.

Steeply increasing the tax rate on carbon dioxide every was viewed as necessary to transition away from carbon-emitting tech, as the ever-mounting cost of maintaining emissions-intensive technology over the years would have eventually made them undesirable for most businesses. Having been negotiated to a lower rate, the tax will likely have a lower overall impact on South Africa’s total emissions, a problem for reaching its commitment under the Paris Climate Agreement. Patrick Curran of the London School of Economics said in a statement to Business Green, “It is crucial that the tax rate is strengthened in future reviews, starting in 2022, to support meeting South Africa's national and global climate change objectives.”

In addition to the carbon tax, efforts to reduce overall emissions lie in fixing Eskom, South Africa’s public electricity utility company which is currently undergoing a restructuring to make South Africa’s electricity sector friendlier for renewable energy technology. South African Finance Minister Tito Mboweni said in a budget speech announcing the restructuring, “The sustainability challenge affects us all. Climate change is real. The steps being undertaken at Eskom will allow us to expand renewable energy, and the carbon tax will come into effect from 1 June 2019.”

Having been passed by the parliament, the carbon tax bill now must also be signed by the National Council of Provinces and the President, both considered to be a rubber stamp, before it becomes law.